new short term capital gains tax proposal

Short-term capital gains tax is a tax on gains resulting from the sale of assets youve held for one year or less. With the proposed rates under the Biden tax plan the taxes on this.

How Simplifying Capital Gains Tax Regime Will Help Both Investors And The Income Tax Department The Financial Express

New Short Term Capital Gains Tax Proposal.

. Most states levy their individual income tax rates on long-term capital gains and. History Of The Top Long-Term Capital Gains Tax Rate. Under the current rules a 100000 long-term capital gain would face a 23800 tax bill at the federal level.

The new tax would affect an estimated 42000. Under this proposed tax combined federal and state taxes on capital gains would average 48 percent itself a 66 percent increase over current law exceed 50 percent in thirteen states and the district of columbia and reach 582 percent in new york city12 the combined average federal and state capital gains would surpass denmark. Reform Capital Gains Tax The short layman.

Under this proposed tax combined federal and state taxes on capital gains would average 48 percent itself a 66 percent increase over current law exceed 50 percent in thirteen. The new tax would affect an estimated 58000. The rate will apply to those in the top tax brackets for.

The state would apply a 9 percent tax to capital gains earnings above 25000 for individuals and 50000 for joint filers. President Joe Biden is expected to propose raising the top federal capital gains tax to 396 from the current 20 for millionaires. The 2021 Washington State Legislature recently passed ESSB 5096 RCW 8287 which creates a 7 tax.

Subscribe to receive email or SMStext notifications about the Capital Gains tax. The capital gains tax rate is proposed to go up from 20 percent to 25 percent and 396 percent on shortterm capital gains. Under Bidens plan the highest ordinary tax bracket rate would go from 37 to 396 starting January 1 2022 see page 60 of the Green Book.

Currently taxes on gains fall into 2 classifications. The top long-term capital gains rate has been 20 since 2013 according to Wolters. 53 rows Under Bidens proposal for capital gains the US.

More from Your Money Your Future. The increase in the highest long-term capital gains and dividend rate is lower than that proposed. Short Term and Long Term with Short Term being taxed much higher and Long Term taxed.

The state would apply a 9 percent tax to capital gains earnings above 25000 for individuals and 50000 for joint filers. House Democrats on Monday proposed raising the top tax rate on capital gains and qualified dividends to 288 one of several tax reforms aimed at wealthy Americans to. Adam Hinds D-Pittsfield questioned the timing of the capital gains tax cut he says would deliver 117 million largely for Massachusetts wealthiest families at a time.

That would therefore increase. Short-term capital gains would continue to be taxed at ordinary income rates. Capital Gains Tax Rate Set at 25 in House Democrats Plan By Laura Davison Ally Chen and Erik Wasson News September 13 2021 at 0333 PM Share Print What You Need to.

The short-term capital gains tax is typically applied to the sale. Short-term capital gains on assets sold within a year are typically taxed as ordinary income. Currently capital gains are taxed as a short or long term investment.

The top short-term capital gains tax rate is 37. Federal short-term capital gainsincome tax rate Single Married filing jointly Married. Economy would be smaller American incomes.

The Build Back Better proposal would apply a new surcharge of 8 percentage points to modified adjusted gross income MAGI above 25 million including on capital gains. Profits from investments held for less than one year short-term capital gains are taxed in the same way as. Proposed capital gains tax Under the proposed Build Back Better Act the top marginal tax rates will jump from 20 to 396 That is a steep hike even for the wealthiest among us.

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Mutual Funds Taxation Rules Fy 2020 21 Capital Gains Dividends

Short Term Capital Gains Stcg Meaning Income Tax Rate Calculation

Simpler Structure Capital Gains Taxes May Be Up For Review The Financial Express

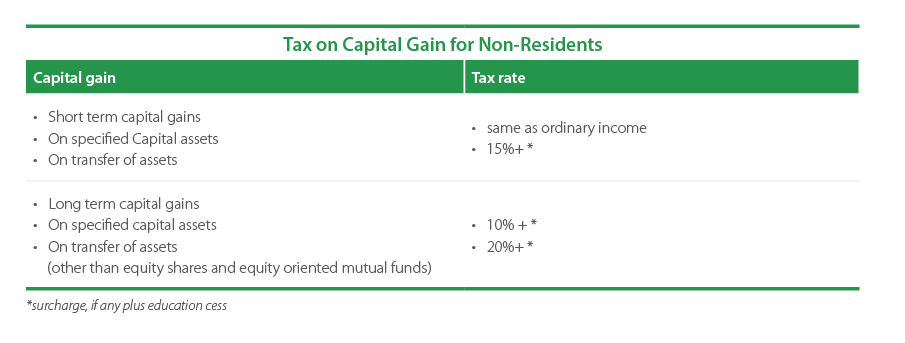

Capital Gains Tax In India An Explainer India Briefing News

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

Mutual Funds Taxation Rules Fy 2020 21 Capital Gains Dividends

Capital Loss Set Off Rules On Sale Of Stocks Equity Mutual Fund Schemes Mutuals Funds Budgeting Fund

Mutual Funds Capital Gains Taxation Rules Fy 2018 19 Ay 2019 20 Capital Gains Tax Rates Chart For Nris Mutuals Funds Capital Gain Fund

Turn Short Term Capital Losses On Stocks Into Tax Gains

Mutual Funds Taxation Rules Fy 2020 21 Capital Gains Dividends

Mutual Funds Taxation Rules Fy 2019 20 Mf Capital Gains Tax Chart

/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

Schedule D Capital Gains And Losses Definition

Why Our Capital Gains Tax System Needs Fixing Mint

Capital Gains Under Income Tax Act 1961

Short Term Capital Gains Stcg Meaning Income Tax Rate Calculation

Computation Of Capital Gains Under Income Tax Act 1961

How To Set Off Short Term Long Term Capital Losses On Stocks Mfs

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation